Demand for oil and gas expected to fall

By Nasser Almatrouk

(Hughes Hall College University of Cambridge)

For a lengthy period, the enduring viability of oil earnings in GCC economies has been a major worry, leading to several initiatives to diversify their economies through policies, plans, and reforms.

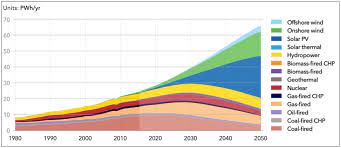

As the globe shifts to renewable energy and aspires to achieve net zero carbon emissions by 2040, demand for oil and gas is expected to fall.

Oil revenues account for more than 70% of GCC countries’ total revenues. Despite this, the transition from surplus to deficit in fiscal balances indicates that the GCC region is still experiencing turbulence. Amidst elevated oil prices, several GCC economies struggle to meet fiscal break-even levels, highlighting the urgent need for alternative revenue sources. Continuing energy price volatility impedes economic diversification efforts.

The long-term viability of hydrocarbon revenues in economies of the GCC is in jeopardy. Despite the continuing significance of oil, it is crucial to diversify revenue sources. Adopting proactive measures, such as investing in renewable energy, fostering innovation, and establishing new industries, is vital for ensuring the resilience and prosperity of GCC economies in the face of altering global dynamics.

Deep diving into Kuwait’s unique case of lack of progress toward its plans to diversify its sources of income away from oil, which continues to account for 90% of its annual revenues, with 80% of its budget spent on salaries and subsidies for the past ten years, the country is trapped. With a projected 22.6% increase in crude production costs and volatile oil prices, Kuwait anticipates a budget deficit of approximately $22 billion. The average price per barrel required for budget break-even in fiscal year 23/24 is $92.9.

To surmount such obstacles, Kuwait’s sovereign wealth fund and pension fund, which manage a combined $900 billion, are required to support the economy by increasing their local exposure and incorporating sustainable investments into their investment decisions. This could be accomplished either voluntarily through asset allocation by upper management or through parliamentary legislation, which has been experiencing a period of instability due to repeated dissolutions.

Kuwait must promptly generate revenue from crude oil exports to advance the reform program and diversify its economy from relying on oil. Shortly after the Russian invasion of Ukraine, oil prices rose to near-record levels, resulting in revenue for Kuwait of $76 billion in 2022. Regardless, the Kuwaiti budget posted its tenth deficit in a row.