China cuts benchmark lending rate, 1st in 10 months

TOKYO, June 20 (KUNA) -- China's central bank cut its benchmark lending rate on Tuesday for the first time in 10 months.

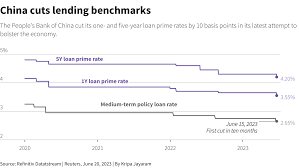

The People's Bank of China announced in a statement that it has lowered the one-year loan prime rate, a benchmark for corporate loans, by 10 basis points from 3.65 percent to 3.55 percent. It was the first rate cut since August last year.

In addition, the central bank trimmed the five-year loan prime rate, which is used to price mortgages, by 10 basis points from 4.3 percent to 4.2 percent, also for the first time since last August.

Last week, the central bank cut the rate of its one-year medium-term lending facility loans to some financial institutions from 2.75 percent to 2.65 percent, and lowered the seven-day reverse repurchase rate, which is used for short-term liquidity to banks, from 2 percent to 1.9 percent.

Zeng Gang, Director of the Shanghai Institution for Finance and Development, said the policy rate cuts last week led to Tuesday's rate reduction, state-run Xinhua News Agency reported.

Zeng said it will effectively drive down real loan interest rates, reduce financing costs, stimulate credit demand, and strengthen the growth momentum of consumption and investment, according to the report.

The world's No. 2 economy grew 4.5 percent year-on-year in the first quarter, missing the government-set 2023 growth target of around 5.0 percent. (end) mk.mt.